✅ What is Bitcoin

Bitcoin is a cryptocurrency, a virtual currency that is designed to function as money and is a method of payment outside the control of any individual, group, or entity and thus the involvement of third parties in financial transactions. eliminates the need.

It rewards blockchain miners for their work in validating transactions and can be purchased on various exchanges. The cryptocurrency was invented in 2008 by an unknown developer or group of developers using the name Satoshi Nakamoto.

It rewards blockchain miners for their work in validating transactions and can be purchased on various exchanges. The cryptocurrency was invented in 2008 by an unknown developer or group of developers using the name Satoshi Nakamoto.

It has since become the most famous cryptocurrency in the world. Many other cryptocurrencies have sprung up as a result of their popularity. These competitors attempt to either replace it as a payment system or be used as a utility or security token in other blockchain and emerging financial technologies.

✅ What is Bitcoin Blockchain

A bitcoin blockchain is a database of transactions protected by encryption and validated by peers. See here how it works. Blockchain is not stored in one place; It is distributed across multiple computers and systems within the network. These systems are called nodes.

Each node has a copy of the blockchain, and each copy is updated whenever a valid change occurs in the blockchain. Blockchain consists of blocks, which store data about transactions, past blocks, addresses, and the code that executes transactions and drives the blockchain. Therefore, in order to understand blockchain, it is important to first understand the block.

✅ What is Mining

Mining is the process of verifying transactions and creating a new block in the blockchain. Mining software is driven by applications that are driven on a computer or machine specially designed for mining called application-specific integrated circuits.

✅ What are Wallets

A wallet is a software application used to view your balance and send or receive bitcoin. The wallet interfaces with the blockchain network and identifies your bitcoin for you. A blockchain is an account in which certain parts of Bitcoin are stored. Since Bitcoin is the data input and output, they are scattered across the blockchain because they have been used in previous transactions. Your wallet app finds them, the total amount, and displays it.

✅ What is Cryptocurrency

A cryptocurrency is a sort of digital asset that is built on a distributed network of computers. This decentralized structure allows them to remain outside the control of the government and central authorities.

A cryptographic system underpins cryptocurrency, which is a digital or virtual currency. They make it possible to make secure online payments without the need for third-party middlemen. Elliptical curve encryption, public-private key pairs, and hashing functions are examples of encryption algorithms and cryptographic procedures that secure these inputs.

✅ Types of Cryptocurrencies

The most popular and valuable cryptocurrency is Bitcoin. It was conceived and released to the world through a white paper in 2008 by an unidentified entity known as Satoshi Nakamoto. There are thousands of cryptocurrencies on the market right now.

Some famous cryptocurrencies are Ethereum, Litecoin, Dogecoin, Ripple, Bitcoin, etc.

Also Read: [11 TRENDING WAYS] to Earn 1,00,000 (1 Lakh) from YouTube

✅ What needs to be Considered before Buying Bitcoin?

Bitcoin is an extremely dangerous investment. If you want a “safe” investment with assured rewards, don’t invest in Bitcoin — or any cryptocurrency for that matter. In recent months, the price of one Bitcoin has fluctuated between $25,000 and $60,000. Bitcoin isn’t the only cryptocurrency that could be dangerous; smaller currencies could be even riskier.

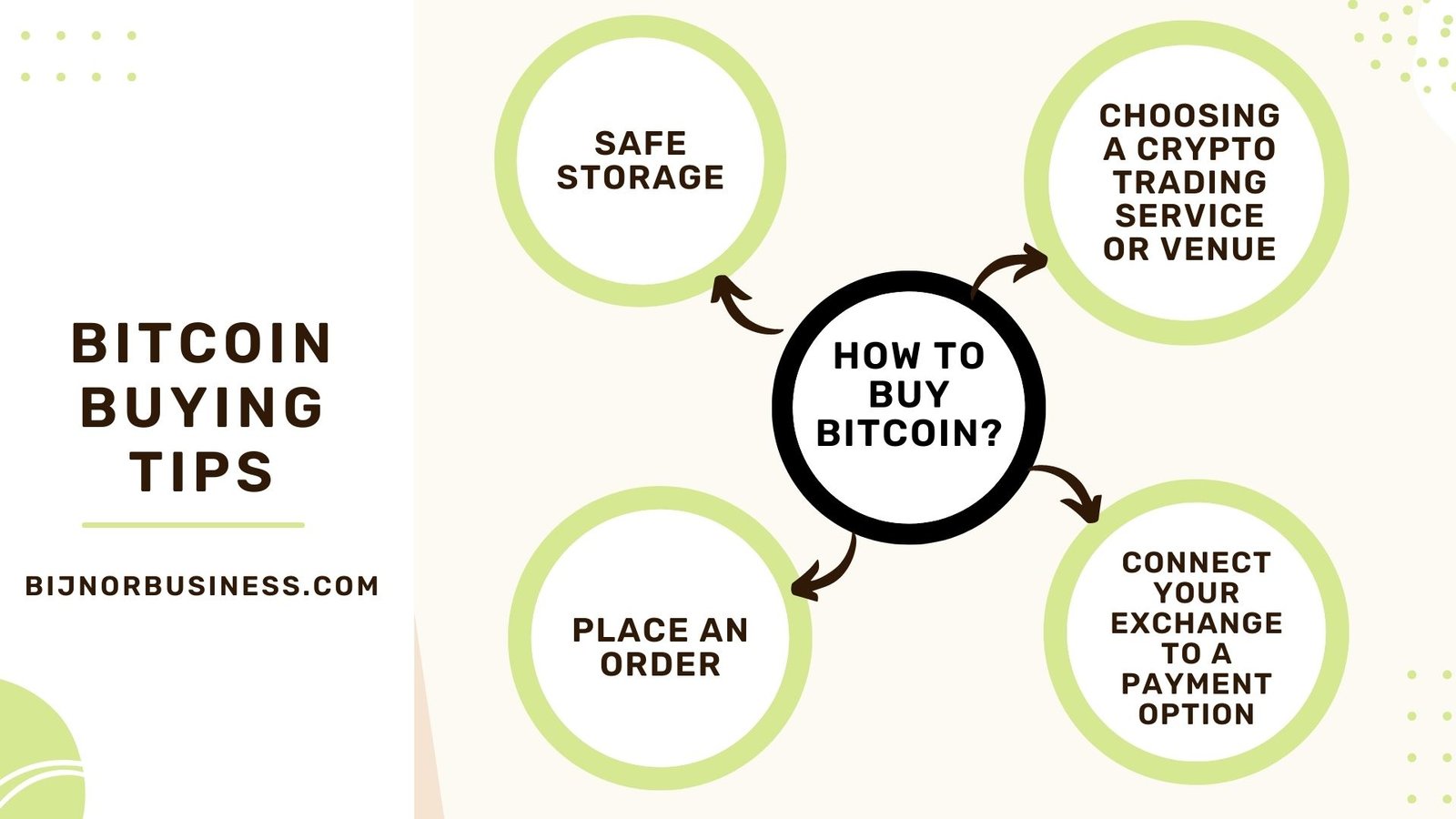

How to Buy Bitcoin?

The steps of purchasing bitcoin are outlined here. Remember to do your research and choose the best answer for you based on your unique situation.

1 Choosing a Crypto Trading Service or Venue

Choosing a crypto trading provider or venue is the first step in purchasing bitcoin. Popular trading platforms and venues for getting cryptocurrencies include cryptocurrency exchanges, payment services, and brokerages. Cryptocurrency exchanges are the most convenient option since they provide a bigger variety of features and cryptocurrencies to trade.

Signing up for a cryptocurrency exchange allows you to buy, sell, and hold bitcoin. Customers should use an exchange that allows them to withdraw cryptocurrencies to their own personal online wallet for security reasons. People looking to trade Bitcoin or other Cryptocurrencies might not care about this feature.

However, the majority of well-known exchanges are currently not decentralized, and consumers must present identification documents. Coinbase, Kraken, Gemini, FTX, and Binance are some of the most popular cryptocurrency exchanges. These exchanges in the United States include to name a few. The number of features available on these exchanges has significantly increased.

2 Connect your Exchange to a Payment Option

The information you’ll need may differ based on where you reside and the restrictions in place. The processes are similar to those needed to open a traditional brokerage account.

You will be asked to connect a payment method when the exchange has validated your identity. You may connect your bank account or a debit or credit card straight to most exchanges. Although it is possible to buy cryptocurrency using a credit card, this is not a smart idea since cryptocurrency price fluctuations might boost the total cost of purchasing a coin.

Different fees apply to deposits made using a bank account, debit card, or credit card. Examine the fees associated with each payment option to help you pick the best exchange or payment option for you.

Exchanges also levy transaction fees. These costs might be either a flat fee (for small trades) or a percentage of the trade amount. In addition to transaction fees, credit cards include a processing fee.

3 Place an Order

You may buy bitcoin after choosing an exchange and attaching a payment method (or other cryptocurrencies). They have considerably extended its liquidity and feature set. The shift in public attitude towards cryptocurrencies corresponds to changes in bitcoin exchange activities. A business that was once thought to be a hoax or one with dubious procedures is progressively evolving into one that has captivated the interest of all of the financial services industry’s key players.

Also Read: [TOP 10] Business Ideas for Accountants (Low Investment)

4 Safe Storage

Wallets for bitcoin and cryptocurrencies provide a safe place to save digital assets. Keeping your crypto in your personal wallet rather than an exchange means that the private key to your money is only accessible to you. It also allows you to hold funds outside of an exchange, lowering the risk of having your assets stolen if your exchange is hacked.

Although most exchanges give wallets to their consumers, security is not their first priority. For substantial or long-term bitcoin holdings, we do not advocate utilizing an exchange wallet.

Different Ways to Earn Money by Investing in Bitcoin

1 Mining

Mining is one of the most profitable methods to generate money using Bitcoin. there are two type of mining as I am explaining here under.

(a) Personal Mining

Personal mining is a sort of individual mining. Bitcoin is one of the most difficult cryptocurrencies for me to understand because of its popular success. Bitcoin’s supply is restricted in comparison to demand. So, after determining the cost of power and maintenance, you may have to compete for large earnings.

(b) Cloud Mining

Cloud mining is popular since there are no recurring fees or escalating power expenditures. The contract simply requires a one-time payment. Furthermore, no software or hardware is required for this. As a result, it’s become a terrific option to private mining because you still get a piece of the pie.

2 Buy and Hold Bitcoin

A lot of people believe in simple formulae. Buying a commodity at a low cost, holding it till the iron becomes hot (and the price rises), and then selling/retaining it. Most long-term investors think like this. To buy Bitcoins, you’ll need a Bitcoin wallet. Invest, hold, and sell your stock (at the correct moment).

If you believe the price of Bitcoins will rise in the future, you may invest and purchase some Bitcoins, then sell them when the price rises and profit. This strategy is unlike short-term investments in that you may need to retain them for a long time because they are not bound to extravagant expectations. However, you must know when is the best moment to sell.

3 Lending Bitcoin

Making and accepting payments with Bitcoins has the advantage of not requiring any third-party validation. You will be able to complete transactions without interruption. So why not lend money to others by lending them Bitcoins at a profit?

Consider it this way, while you aren’t attempting to profit from Bitcoin, you are allowing Bitcoin to profit from you! Isn’t it fantastic?

Many websites, including Bitbond, Unchained Capital, BTCpop, and others, may assist you with your loan needs. It is critical to select a reputable loan source; otherwise, you risk losing all of your Bitcoins. All reputable loan sites provide annual interest rates of up to 15%.

4 Earn Bitcoin as an Affiliate

Using social media sites, you may make a lot of money with Bitcoin. You may work as an affiliate for Bitcoin or any other cryptocurrency firm, promoting their products or services and earning a commission on every sale. The commission is totally determined by the number of customers and sales growth.

You can use your social media followers and explain to customers why they should buy those products/services. You can earn a lot by running an approved program to tell people how to make money with cryptocurrency.